- INTRODUCTION

- TYPE OF BUSINESS ORGANISATION/IMPORTANT REGULATIONS IN THE NEW CORPORATE LAW

A - THE ACTUAL INCORPORATION

B - MEMORANDUM OF ASSOCIATION/CONTENTS OF STATUTS. - TAXATION

- EMPLOYMENT

- BANKS AND INITIAL INVESTMENT

- LINKS

Ad 1 - INTRODUCTION

The purpose of this website is to provide information from the law firm Homann of the assistance that the law firm can offer as concerns the establishing of business in Denmark, hereunder incorporation. Within the law firm we have specialists who can team together and perform a due diligence, and we can also assist in buying and selling businesses including taking part in negotiations and drawing up contracts, giving advice concerning agent- and distributor contracts. Furthermore we can advise you whether or not to set up a holding company and advise you concerning a share holders´ agreement.

It will probably interest you to know that the Danish company Act is in conformity with the EU legislation and furthermore that Denmark has an advanced online registration of companies which constitutes that a new business can set set up very swift. You can eventually read more about these legal and practical matters on www.eu.business.dk.

It may be essential for you to know that Denmark is a member of the EU. Our office is domiciled in the Øresund Region, which has two sections namely a Danish part and a Swedish part connected by the Øresund Bridge, which opened on July 1. 2000. The Øresund region is connected with the other main parts of Denmark by bridges and there is also an easy access to Germany. Through our network JCA we are in a position to help you establishing business cross border as well. The following informations are anyhow restricted to doing business in Denmark.

Ad 2 – Type of business organisation/important regulations in the New Corporate Law

A.

Establishing of business in another country

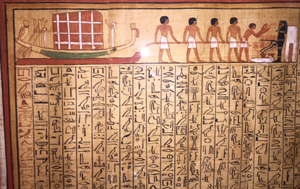

Establishing of business in another country

can be a deadly procession

Incorporation in Denmark includes different kind of companies whereof the most common is a private company called anpartsselskab and a public limited company called aktieselskab. The statutory capital is respectively 40.000 Danish Kroner - the basis capital was on 15. April 2019 regulated by the government from 50.000 Danish Kroner- and Danish Kroner 400.000 Danish Kroner. We still reckon in Danish Kroner and not EUROS.

The founders of the anpartsselskab are under obligation to see to that the full statutory capital is fully paid up capital. As regards the statutory capital in the aktieselskab the founders are under obligation to pay up as a minimum 25% of the capital at the foundation of the company. The outstanding shareholder debt is to be paid at any time if the management of the company decides it.

aktieselskab is called an A/S

aktieselskab is called an A/S

The former possibility for an innovator/start up/entrepreneur to establish a company with a capital amounting to one Danish Kroner - a so called IVS - has with effect from April 2019 been abolished as mentioned above. Already established IVS’s can be upheld but they must restructure the IVS to an ApS and this conversion should be carried out before 15 April 2021. As many start up’s probably have a negative net capital, they are in the risk of suffering an enforced dissolution.

The above mentioned founding regulations are based on a new Companies Act passed by the Danish Folketing in May, 2009. The Act has now for the majority of the provisions come into into force from March 1.st. 2010. It is from then on the new minimum conditions for share capital that the founders of companies will have to comply with. For a more detailed specification of the new provisions see the article New Corporate law in Place by Hans Henrik Skjødt and Thomas Torré Christiansen.

You can read about the Danish Companies legislation on www.danishbusinesslegislation.dk

Any incorporation must be registered with the tax authorities and the company will receive a so-called CVR No. under which all financial accounts and VAT statements must be reported.

A foreign investor, which is incorporated, might choose instead to establish a subsidiary in Denmark. This involves special regulations to be followed. A business manager is to be employed and it is compulsory. The business manager is personally liable for VAT and taxes.

As well as the above-mentioned companies the subsidiary will be registered in the Danish Business Authority.

It is possible to carry out all registrations in connection with the foundation of a company via internet access. For compulsory foundation conditions see ad B.

EU cross border companies established within the rules of the EU Council Directives (which are implemented in Danish law) are off course acknowledged in Denmark.

From 8th October 2004 EU Regulation 2157/2001 – as well as the Danish Supplementary Act – is coming into force. This regulation constitutes that a company – the so-called Societas Europaea or SE-company – can be founded in any EU membership country with the purpose of performing cross boarder business.

A SE-company can only be founded by existing EU-companies and one of the following founding methods is obligatory:

- Cross boarder merger.

- Founding of a SE-holding company.

- Founding of a jointly owned SE-subsidiary company.

- Conversion of a public limited company to a SE-company.

Whether or not it is a good idea to found a SE-company is a very complicated decision, which has to be carefully scrutinized with the legal and accountancy advisers of the company. The primary reason may anyway be the easy access to mergers, to move the head office from one EU-country to another or perhaps the wish to avoid local members of the board of directors (“branchizing” of subsidiaries!).

B.

The following information’s are compulsory in the memorandum of foundation:

- Name and address of a founder person and if the founder is a company the VAT no. of the company.

- The rate of issue of the capital in the company.

- Time during which subscriptions are received and the actual terms for payment of the capital.

- The date from which the foundation shall have legal effect.

- The date from which the foundation shall have effect as pertaining to accounts.

- Information as concerns weather or not the company shall defray the expenses connected with the foundation of the company and if the answer is in the affirmative the size of the expenses.

If the memorandum of foundation contains regulations as concern special rights for founders, if the company is being inflicted essential obligations, if the company is founded on a contribution of non-liquid assets, if the company is founded without an obligation to submit an audited annual account (which is legal under curtain circumstances), what part of the total company capital that has been paid in fully, are to be part of the memorandum of foundation if the aforementioned conditions are in any way part of the foundation.

Compulsory information as concern the statutes:

- Name of the company.

- Object clause/business purpose.

- Size of shares/parts in the company (it is legal to issue no-par-value-shares and it is furthermore legal to issue shares/parts without voting value).

- Rights of shareholders/part owners.

- Management (either a one-stringed or two-stringed system).

- Rules for the summoning of a general meeting.

- Financial year of the company.

If there is an equity of redemption (it is legal to state a termination date for the company), right to conduct a general meeting on the basis of electronic devices, special rights for the shares/parts restrictions in the right to transfer a share/part and restrictions to see who is registered as an owner of shares/parts, this will also have to be a part of the statutes.

It is very important to observe that shareholder agreements no longer are binding for the company and decisions taken on the general meeting. Such internal regulations/restrictions will then eventually have to be incorporated into the articles of association

It is also compulsory - now EU rules- to submit informations to the Company Register(= Erhvervsstyrelsen) about the owners of shares who shall be registered and the so-called ownerbook has public access. PhotoID - passports for founders not domiciled in Denmark - has to be available for the advisers assisting. The obligation for the shareowner to register himself also applies for board members of Foundations(=fond) and if the Foundation has subsidiary in the form of a company the board members shall with effect from 1.st July 2017 be registered as owners.

It is furthermore of major importance to observe that shareholders(in the New Corporate Law termed capital owners) , board members and management are prohibited to receive loans as such and security For loans.

One noteworthy exception is a loan to a parent company.

As for e.g. UK companies it is also prohibited for the company to provide financial assistance to a director to buy its shares. There are some very specific exceptions to the main rule and this we of course can advise on.

Ad 3 - TAXATION

The man with the axe is cutting the profit

The man with the axe is cutting the profit

The company tax for both foreign or Danish companies is in Denmark in 2014: 24,5 % and in 2015: 23,5 % and finally in 2016: 22 % and this taxation rate continues in 2017 etc.. The taxation rate is of course calculated of the taxable income. As Danish tax legislation has some rather complicated regulations as concern deducted ability of interest and expenses, please seek more detailed advise from one of our lawyers specializing in taxation regulations.

Please be aware that dividend distribution from a daughter company to a holding company can be tax-free according to EU-directive 90/435/EEC or according to Double Tax Treaty Regulations.

Ad 4 - EMPLOYMENT

The labour market in Denmark is mostly governed by labour agreements (collective wage agreements). Terms of notice have to be construed within the frame of these labour agreements. Salaried employees´ working conditions are governed by a special act called Salaried Employees Act.

Transfer of a business with employees of any kind is regulated in an Act based on a EU Council Directive.

A commercial agent is not an employee. The EU Council Directive Regulation from 1993 has been enacted in Denmark. This constitutes that there are regulations concerning the duties of a commercial agent to his principal and vice versa, form and amount of remuneration in absence of an agreement, service of notice etc.

As concerns employment legislation in Denmark have a look at www.uk.bm.dk which is the official website of the Danish Ministry of Employment.

Ad 5 – BANKS AND INITIAL INVESTMENT

Purchase of real estate can be financed in a building society; see also the article Investment in Commercial Properties/residential rental properties in Denmark. Working capital has to be financed otherwise and most likely by self-financing, as the major Danish banks normally will ask for security before granting a loan. There is a free transfer of capital for investments, but the transfer has to be in compliance with the EU rules of money laundering and the Danish acts no. 385 and 392 of 25 May, 2009.

FOR FURTHER INFORMATION CONTACT:

Hans Henrik Skjødt, partner

Bent-Ove Feldung, partner

Thomas Torré-Christiansen, partner