Concerning danish citizens/habitual residence

A - Death estate handling in Denmark

B – The Danish Inheritance Act- Danish subjects living in an EU-country/taxation of inheritance/gifts from countries outside Denmark.

- Handling of non-Danish subjects real estate in Denmark.

- Inheritance tax/taxation of death estates in Denmark.

- Practical issues/legalized and certified documents

Ad 1 A - Death estate handling in Denmark

If the deceased was domiciled/had his habitual residence in Denmark the death estate has to be winded up by the local Probate Court in the municipality where the deceased had his last known address.

This is in compliance with § 2 in the Danish Death Estate Division Act.

As concerns real estate situated outside Denmark – see also Ad 5 – Denmark of course comply with – so to speak – local rules; e.g. the deceased owns property in Greece, Spain, UK, France etc. this real estate will have to be winded up in the country – and by the local probate court – where the property is situated. Often it is much more bureaucratic/complicated then if a foreigner owns property in Denmark, but that is the way it is. Especially Italy and Greece can be challenging. Anyway: the good advice is to use a local lawyer, but be aware that they have a specially secured client account and a liability insurance covering the handling of the sale and calculation of taxation. It is not necessarily so that the lawyer in – e.g. – Greece and Italy fulfill these conditions. See also section Ad 3 and Ad 5 (practical issues).

Denmark has not acceded to Regulation No. 650/2012 of The European Parliament on jurisdiction, applicable law, recognition and enforcement of decisions in matters of succession.

Denmark has on 3. December 2015 in a referendum rejected – among other Regulations and cooperation affiliations( e.g. Europol) the accession of the aforementioned Regulation. This Regulation cannot therefore be invoked in Denmark.

The aforementioned EU-regulation states that the course of an EU-country in which the deceased had his habitual residence at the time of death shall have jurisdiction to rule on the succession as a whole. If for instance a Danish citizen worked and lived in Brussels, Belgium, the heirs in Denmark can obtain – through a Belgium Court – an European Certificate of Succession. The heirs can then exercise their rights as heirs and e.g. give instruction to the Belgium bank concerning the transfer of the balance to a Danish bank.

This regulation can be applied to the succession of persons who died on or after 17 August 2015.

It is stated in the Regulation that authentic instruments enforceable in one EU-country where they have been established, shall be enforceable in another EU-country when, on the application of an interested party, they have been declared in force able there by the local court or competent authority.

The reading of a will.

The reading of a will.

When this has been stated, please be aware that – to stick with the example of Belgium – the Belgium tax authorities are not allowed to tax the Belgium assets belonging to the deceased Danish citizen. As specifically concerns Belgium tax law a “declaration of estate” has to be filed by the heirs within four month after the death. The specific EU-countries have different regulations concerning the taxation of a death estate.

Exempt from EU Decree 650/2012 are Denmark and Ireland - UK has brexited and the Haager Convention is then regulating “will-crossover-matters” - but a Dane and an Irishman - and of course any EU citizen domiciled in another EU country can choose ad a law to govern his succession, the law of the country who’s nationality he possesses at the time of making the choice or at the time of death. A person with multiple nationalities may choose the law of any of the countries, who’s nationality he possesses.

I have recently experienced a curious mixture of inheritance law in England in connection with The Hague Convention from 1961 and the Danish Inheritance Act. The British citizen died in Denmark after living here for about 6 years. He left a will in England and all of his assets – he had 2 children of the marriage – should be passed on to a trust, which we in Denmark – if we did approve of it as a legal person – could consider as a family foundation, when the dividends in the trust were to be allocated to the children..

Churchyard in Nuuk

Churchyard in Nuuk

The British lawyer claimed that the entire death estate was to be winded up in England. I did not consider this in compliance with the remarks in the beginning of this article and I held the opinion that the total winding up was to be carried out in Denmark and the legitimate inheritance should be calculated according to the Danish Inheritance Act. The result was a compromise whereby the child living in UK got the right to the trust in UK and the child living in Denmark inherited the debt, that he had to his deceased father, and the deceased’s debt to the UK family trust was so to speak set off. To put it in another way: One winding up was carried out in UK and one in Denmark – and of course inheritance taxes were paid.

Finally UK residents and non-domiciled individuals in UK have to have in writing if they are not supposed to be taxed of income/dividend from assets outside the UK. Furthermore they will need to have in writing that there is no inheritance tax as well on assets outside UK. There is no doubt non-residents are subject to inheritance tax on UK residential properties regardless of the structures they are held in.

I have often through UK residents experienced that the UK trustee of a death estate will not wind up assets outside of UK. I have from a UK lawyer connection been told that it will depend on the status of the deceased at death and an UK trustee will certainly at the least report obligations on UK income and gains and inheritance tax on UK assets. In my opinion then it will be a good idea to – specially when a UK resident used to live I Denmark – draw up a will e.g. in Denmark and with a trustee who is authorized to wind up assets outside the UK. I have already above in section 2 dealt with § 2 in the Danish Death Estate Division Act. There is a special clause stating that if the deceased was not domiciled in Denmark, the Ministry of Justice can refer a death estate or part if this to be handled by a Danish probate court under certain conditions and especially if there are assets in Denmark, which assets are not drawn into the death estate in another country.

In a recently published judgement – UfR2018.1281-1283 – the Danish High Court, Østre Landsret, has passed a decision that the winding up statement in a French citizen’s death estate – domiciled in France – should be in compliance with the French Inheritance Act. The French citizen owned real estate in Denmark and the Danish part of the winding up statement was carried out in compliance with the Danish Inheritance Act. It is stated in the High Court decision that the Danish rule concerning the choice of relevant law in inheritance matters leads to that inheritance matters should be ruled in compliance with the deceased’s domicile.

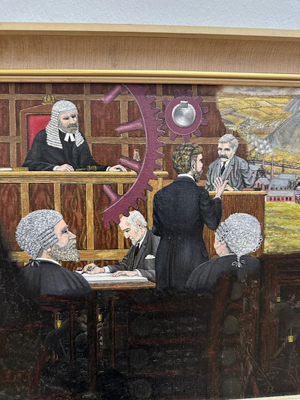

Barristers and solicitors are very detailed

Barristers and solicitors are very detailed

in UK and the Probate Courts usually very slow

This is to inform the readers of this article that I in the past 6 months in 2023 have had some new experiences with the Municipal Probate Court of Copenhagen, who not as easily as before pass a court decision concerning the possibility of handling a referral death estate in Denmark; when the deceased was domiciled in a another country – and even if there was property situated in Denmark. As regards this situation, I assisted a Canadian trustee and as an authorized trustee in Denmark I found it much easier to act as a trustee, when the deed was to be registered with the Digital Registration Office. The probate court judge in Copenhagen would not allow such a release of the death estate, and I had to act in compliance with the Canadian trustee’s probate court certificate and a power of attorney, which gave a lot of problems with the Danish Digital Registration Office, and the problem is still not solved.

In another matter – where I had the task from a lawyer in Washington and it dealt with a Danish citizen, who was domiciled in Washington – I was referred to try to use the Washington lawyer’s probate court certificate and a power of attorney in effort to get bank accounts released from Danske Bank and Jyske Bank. It turned out that a very large balance was released without any questions from Jyske Bank, but I have still not gotten a release from Danske Bank.

The ten Steps on the Deathstair by

Salomon Savery

I can however see the point that Danish authorities etc. as a main rule comply with foreign court decisions etc.

For more information see www.successions-europe.eu, www.ec.europa.eu, www.justitsministeriet.dk and www.um.dk.

Especially the website of The Ministry of Foreign Affairs contains a lot of relevant information on the sub website mentioning Inheritance and administration of estates abroad, there is a reference to the Danish Ministry of Justice as concerns death estates in Denmark.

Ad 1 B – The Danish Inheritance Act

Spouses and children and their children are legitimate heirs.

The legitimate inheritance is ¼ and if the legitimate heir is a child, then the legitimate inheritance can be reduced to a maximum of DKK 1 mill., which amount is index-tied every year and amounts to DKK 1.410.000,00 in 2023.

A testator, who is single, but has children, can accordingly allocate ¾ of the estate to other heirs than the legitimate heirs – on the condition of course, that there is a will stipulation this division of the death estate.

The longest living of a married couple – presupposing that they have joint property and children of the marriage – has a legal right to take over the joint property as an undivided estate. If the undivided estate – e.g. if the longest living spouse is to be married again – the division will be, that the longest living spouse is entitled to have half of the joint estate, not as a heritance, but a statutory right of division and it is therefore the “second” half that is to be divided between the longest living and any given legitimate heir.

A separate property will always have to be divided, when the intestate dies. If an intestate is not married and leaves no children and no will, the death estate will be divided in the way that parents each receive half of the death estate and if a parent has not survived the child, then siblings divide the share equally and if there are no siblings, then the surviving parent will inherit everything. If there are no surviving parents or siblings, then nephews and nieces will inherit (but not cousins).

Ad 2 - Danish subjects living in an EU-country/taxation of inheritance/gifts from countries outside Denmark

The main rules for the handling of the death estate will be as stated in part I.

Please be aware of a persons right to choose the law to govern his succession and this choice might be the law of the country of the habitual residence or the nationality of the deceased.

In general I strongly advise that before any discussions are carried out concerning payment of advance inheritance or gifts from testators/intestates living abroad and which transfers are involving beneficiaries living in Denmark that a local solicitor/auditor is consulted.

In Denmark an advance inheritance is considered equivalent of a gift and gifts from parents to descendants are to be taxed with 15 % of the amount that exceeds the tax free gift amounting to DKK 70.500,00 (2020). If there is a local taxation, the local advisor will have to look into that question.

It might be better to consider a loan from the parent(s) to the descendant and which loan can be with or without interest, but always a loan which has to be paid back on demand from the creditor.

Da jeg efterhånden har været involveret i en del boer med udspring i England, skal jeg henlede opmærksomheden på, at der kan søges på eventuelle i UK oprettede testamenter på The National Will Register and Certainty Will Search Service.

Ad 3 - Handling of non-Danish subjects real estate in Denmark

The Egyptian passage of death

The Egyptian passage of death

Even if the Regulation 650/2012 stipulates how a death estate is to be handled and divided real estate in a certain country will most likely have to be winded up under the auspices of the local probate court. As most countries approve of the principal of unity of succession the real estate is winded up e.g. in Denmark, and then the net asset is transferred to the death estate in another EU-country and will of course be a net asset in the winding up statement here. See part IV for taxation of real estate etc. in Denmark.

I have during the summer 2023 been trying to register a transfer of a Danish property to a Danish purchaser from a Canadian death estate, handled by a trustee in Canada. I was by the Municipal Probate Court of Copenhagen denied a concrete handling of this part of the death estate in Denmark and the message was that in compliance with the universality principal I could get a power of attorney from the Canadian trustee and sell the Danish property and also register the transfer to the new owner. I have found this very difficult with the Digital Danish Registration Office, but maybe I will succeed in the actual registration later this year!! My conclusion for now is that it is best to have the Danish assets released to a probate court handling in Denmark; when this is stated, I have anyway succeeded in getting rather large Danish bank accounts released after instruction from a trustee in Washington DC, who gave me a power of attorney.

Ad 4 - Inheritance tax/taxation of death estates in Denmark

If the death estate is winded up in Denmark there is a 15 % inheritance tax for natural children and an additional tax of 25 % for all other heirs expect for spouses who do not pay inheritance tax at all and non-profit foundations, which can apply for non-taxation. There is a basic personal allowance before the inheritance tax is calculated and in 2023 it is fixed at 321.700 DKK. The 25 % additional inheritance tax is calculated after the deduction of the 15 %.

In UK you could at one time pay in estate assets;

In UK you could at one time pay in estate assets;

e.g see this painting you can see in Cardiff National.

It is cash in Denmark

If a Danish death estate in 2023 has net assets for more than 3.160.900 DKK there is an income tax as well as the inheritance tax. The tax is calculated with 50 %, but the death estate is entitled to deduct 6.400 DKK every month, but as a maximum for 12 month.

The taxation/inheritance tax rules differ a lot. E.g. in England the rule is that if the estate has a value in excess of 325.000 £ then anything above that threshold will be subjected to inheritance tax IHT at 40 %. If IHT is payable then it must be settled before a Grant of Probate can be obtained.

Belgium has a very strict rule concerning the time limit for submitting a “declaration of estate” to the probate court. This must be filed by the heirs within four month after the death and if this is not being carried out, there is some “heavy fines”.

I suggest you in each individual death estate matter to take contact with our local JCA-member – www.jca-lawyers.com.

Please be aware that we in June 2019 had a new parlamentary majority who is planning changes to the taxation of inheritance and death estates; as per the latest date of this article there are no news concerning changes in inheritance rates and taxation of death estates.

Conclusively I draw your attention to the fact that to comply with Danish taxation rules, a gift from a parent living in Denmark to a child domiciled outside Denmark, incurs a tax of 15%, which is the same rate as in inheritance matters; see above. A gift amount of DKK 71.500,00 in 2023 does not incur inheritance/gift tax. The situation is the same if the donor is domiciled outside Denmark (but the receiver of the gift is domiciled in Denmark).

As concerns inheritance tax to and from another country than Denmark, an heir living outside of Denmark, who is inheriting a deceased living in Denmark, will have to pay inheritance tax. An heir living in Denmark, and who is inheriting an intestate/testator living outside Denmark, will as a main rule not have to pay supplementary inheritance tax in Denmark.

Churchil’s last resting-place in Bladon and

like complicated foreign inheritance matter

layers and layers in the beautiful church

windows

Finally based on several inquiries during the years I have been an authorized trustee winding up death estates, I find it necessary to nail down that Danish inheritance taxation rules are only applied if the deceased had a domicile in Denmark (local venue) or if the death estate is referred from another country to be winded up by a Danish probate court (typically if the specific country’s probate court system cannot undertake to a local winding up and as an example this goes for e.g. Thailand) or if one of the assets in a foreign death estate consists of property situated in Denmark. Citizenship of the deceased and the heirs are in these matters irrelevant for the obligation to pay Danish inheritance tax – even if the heir and the deceased were living outside Denmark. However the “piano is not so well tuned” that if you are living in Denmark and inheriting from an intestate/testator domiciled in another country, the main rule is that you are not under obligation to pay a supplementary inheritance tax in Denmark; not even concerning inheritance from Sweden and Norway, where the inheritance tax is zero.

Ad 5 - Practical issues/legalized and certified documents

Les Alyscamps/ Necropolis in Arles

Les Alyscamps/ Necropolis in Arles

As a main rule there are two ways of dealing with solvent death estates in Denmark. Both involves submitting a written request to the local Probate Court asking for the release of the death estate to the heirs/trustee on behalf of the heirs. It is then either a private handling carried out by the heirs or handling by a trustee who is either appointed in a last will and testament/or by all the heirs in consensus or alternatively a trustee authorized by the Probate Court. If there is no last will and testament designation of a trustee the heirs can in consensus – which means power of attorneys from all the heirs – ask the Probate Court to appoint a trustee which nearly always has to be a lawyer du to complicated insurance matters.

Irrespective of which of the aforementioned ways to handle a concrete death estate it is compulsory to issue a notice to the creditors of the death estate to send in claims either to the trustee or to the representative appointed by the heirs in the death estate handled by the heirs themselves. This notice is inserted in the National Gazette.

Les Alyscamps/ Necropolis in Arles

Les Alyscamps/ Necropolis in Arles

It is then compulsory – in both kinds of death estates – to submit an opening status to the tax authorities and the Probate Court at the latest 6 months from the death. The tax authorities have 3 months after having received the opening status to raise an objection against the figures in the opening status. When this time limit is expired and of course all matters in the death estate have been winded up, the trustee/the heirs are obligated to draw up a winding up statement. In both kinds of death estates the heirs shall approve of the winding up statement. The tax authorities then again have 3 months to raise any objections and there might of course be a taxation issue. After the expiration of the 3 months time limit, the Probate Court will calculate the inheritance tax and the Probate Court tax.

Winding up of death estates can be

Winding up of death estates can be

a patchwork.

The trustee will besides the obligatory lawyer’s insurance policy have to obtain a special insurance policy covering all the assets. There is no claim for this in a private winding up which can be carried out by one heir – or a lawyer – on behalf of all the heirs. To put it in another way: they all have to agree on a private winding up and they are all liable for taxes and inheritance tax. At least one heir has to be solvent. A private winding up can only run for 12 months plus 3 months to work out the winding up statement. A death estate winded up by a trustee can as a main rule run up till 3 years – but normally it runs for one to two years.

As stated above: real estate situated in Denmark always has to be winded up in Denmark and by the local Probate Court.

As supposed to France, UK and USA a Danish Probate Court usually works very fast and issue the Certificate of Probate very fast and if requested in English. If assets are to be winded up outside Denmark, the Certificate of Probate probably needs a Notary Public to certify the translation and signature. It may furthermore be necessary to have the documents legalized. My latest experience with a certificate of probate, issued by a Danish court in English, was that the authorities in New York – after the document had been endorsed with an Apostille – approved of this certificate.

A Power of Attorney that is to be used outside Denmark, must be in the “local language” and signed in the presence of the Notary Public and the Notary Public’s signature has to be legalized by The Foreign Ministry of Denmark.

The Notary Public at any Probate Court is authorized to carry out the confirmation as mentioned above.

See finally the Danish Foreign Ministry’s guidelines in these matters.

Practical issues concerning assets outside of Denmark

Please be aware that it is not so easy anymore to get bank deposits released from foreign banks, which goes for our kindred brothers in Sweden as well as Spain and Germany. I have a pending matter with Svenska Handelsbanken and will elaborate on the conditions for the release of a rather large safe deposit and bank accounts later.

As concerns the Spanish bank Banco Sabadell, the primary conditions for release of the balance is:

- deed of adjudication and acceptance of inheritance

- liquidation of inheritance tax

- will or declaration of heirs

- certificate of last wills

Even in warm Spain taxation is beneath

the water.

It is essential that all inheritance taxes and taxes as such are paid in Spain or else you will not get “a penny”. You therefore need to have the taxes calculated and approved by the notary public and the local taxation office. I strongly recommend that you engage a lawyer in Spain with a specific knowledge of the above stated procedure. I can hereby as good advice state that even if Spain does not have the regime of “an undivided death estate after the first deceased spouse”, Spain practice that – as a main rule – half of a shared matrimonial property incurs no inheritance tax. It is a good idea to have a Danish probate court to write this in the court book and have the text translated with an apostille, which can then be forwarded to the lawyer in Spain.

I am happy to report that the release of the bank account of a death estate being winded up in Denmark, but with a large bank account balance in Banco Sabadell finally after 1 year has been winded up. I have during this very long process become a lot wiser concerning taxation and inheritance tax in Spain concerning individuals, who have their habitual residence within Spanish territory. The applicable laws for determining habitual residence are the Inheritance and Donations Tax Act (Ley 29/1987 of 18 December) and addendums from 1991 and 2006 (personal income tax).

The simple rule is that if an individual has stayed in Spanish territory for more than 163 days in a given calendar year, this individual is considered to have habitual residence in Spain and this goes as well for the spouse and/or depended under age children, who are considered resident in Spain. In the concrete situation taxes/inheritance tax was deducted from the balance on the bank account and as Spain does not recognize a – Danish – death estate as a separate legal person, the residual amount was transferred to the spouse and the heirs. This was of course very inconvenient as the death estate as such is winded up in Denmark. Luckily for me as trustee there are assets in Denmark to cover taxes here.

As furthermore concerns Spain, I can inform readers of this article that the Spanish Ministry of Justice can issue a declaration of “no will” – of course presupposing that the deceased did not leave a Spanish will.

Finally German banks, hereunder Deutsche Bank, has the following conditions before release:

- the assets of the deceased shall be notified to the competent fiscal authorities and there is a special form concerning this (Erbschaftsteuerliche Unbedenklichkeitsbecheinigung)

- all interest and other proceeds of the assets may be taxable as per the date of death; so the bank will keep withholding tax

- for final processing of the estate, the bank requires full legitimation for the person, that is asking for a transfer of the balance on the account. A special form is to be signed. It is not quite clear whether or not the signature can be carried out before a Danish notary public and then certified with an apostille. Deutsche Bank has as a preliminary step asked for the signature being carried out in a subsidiary of Deutsche Bank!

After having started gathering informations concerning the release of a bank account in Germany – and here with Deutsche Bank – I have experienced that after 9 month of handling with the help of a German lawyer, I have still not had a considerable amount of euros transferred to our client account. German banks still write letters and forward them directly to the Danish trustee and not to the German lawyer, who then have to call the bank in effort to get things moving.

As concerns transfer of shares in a business company in Germany, the purchaser has to go to a notary public! It is the same practice in The Netherlands and it is very bureaucratic, when a country does not have a digital owner book.

Conclusion: Go to a local lawyer.

---oo0oo---

The palette above is of course not full so contact solicitor Bent-Ove Feldung bof@homannlaw.dk for further informations